PRCUA SUPPLEMENTAL BENEFIT OPTIONS (RIDERS)

Accidental Death Benefit (ADB)

This option provides for the payment of the face amount of the certificate (maximum of $100,000), in addition to the amount otherwise payable if the insured’s death result solely from injury caused by accidental bodily injuries and occurs within 90 days after the accident. The benefit expires on the certificate anniversary at the age 65 or at the prior termination of certificate.

Available on Products:

- Whole Life (Ages 10-60)

- Single Premium Whole Life (Ages 10-60)

- Limited Payment Whole Life (Ages 10-60)

- Whole Life Paid Up at 70 (Ages 10-60)

- Renewable Level Terms (Ages 16-60)

Guaranteed Insurability Option (GIO)

This rider provides the insured an option to purchase a specified amount of additional insurance on specified future dates, at standard rates and without evidence of insurability on a permanent insurance plan. The sum insured of the new certificate must be at least the minimum we write for that plan.

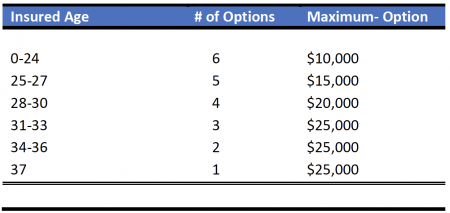

Scheduled option dates are the certificate anniversaries of the basic certificate which are nearest the birthday age of 25, 28, 31, 34, 37 and 40.

Alternate option dates are also available:

- Date of marriage

- Date of first live child

- Date of first legally adopted child

Waiver of Premium (WP)

This rider provides that if the insured becomes totally and permanently disabled, then future certificate premium will be waived provided that the following provisions are met:

- That the disability occurs between ages 16 and the certificate anniversary at the age 60 while the rider is in force

- That the disability is total and continuous for six months before a claim can be filed, except for loss of sight of both eyes, or the use of both hands or both feet or one hand and foot

- That the disability is a result of disease or bodily injury, and is incapable of engaging in any occupation for which the insured has been trained, and is under the care of a licensed physician

PRCUALife may require the insured to periodically furnish due proof of continuance of total disability and to submit to an examination by a physician or physicians designated by it. Such examination shall not be required more than once a year after total disability has continued for 2 years.

Available on Products:

- Whole Life (Ages 0-55)

- Limited Payment Whole Life (Ages 0-55)

- Whole Life Paid Up at 70 (Ages 0-55)

- Renewable Level Term (Ages 16-55)

- Decreasing Mortgage Term (Ages 16-55)

If an alternate option date is exercised then the NEXT regular scheduled option date is automatically bypassed.

The sum insured of the new certificate (exercised option) should be the lesser of: the sum insured on the basic certificate, or the amount in table below – but in no case less than $2,000.

Available on Products:

- Whole Life (Ages 0-37)

- Limited Pay Whole Life (Ages 0-37)

- Life Paid Up at 70 (Ages 0-37)

Juvenile Payor Benefit (JPB)

This rider provides the waiver of premiums on a Juvenile certificate upon the applicant’s death or total and permanent disability provided that the following provisions are met:

- Payor’s death occurs prior to insured’s certificate anniversary’s 25th birthday while certificate was in force

- Or payor’s total and permanent disability prior to insured’s certificate anniversary’s 25th birthday or earlier before certificate anniversary at the Payors’s 60th birthday

- That the disability is total and continuous for six months before a claim can be filed, except for the loss of sight in both eyes, or the use of both hands or both feet or one hand and one foot

- That the disability is a result of disease or bodily injury, and is incapable of engaging in any occupation for which the insured has been trained, and is under the care of a licensed physician

PRCUALife may require the insured to periodically furnish due proof of continuance of such total disability and to submit to examination by physician or physicians designated by us. Such examination shall not be required more than once a year after total disability has continued for 2 years.

Available on Products:

- Whole Life: Insured Ages 0-15 | Payor Ages 20-55

- Limited Payment WL: Insured Ages 0-15 | Payor Ages 20-55

- Whole Life Paid Up at 70: Insured Ages 0-15 | Payor Ages 20-55